how to take an owner's draw in quickbooks

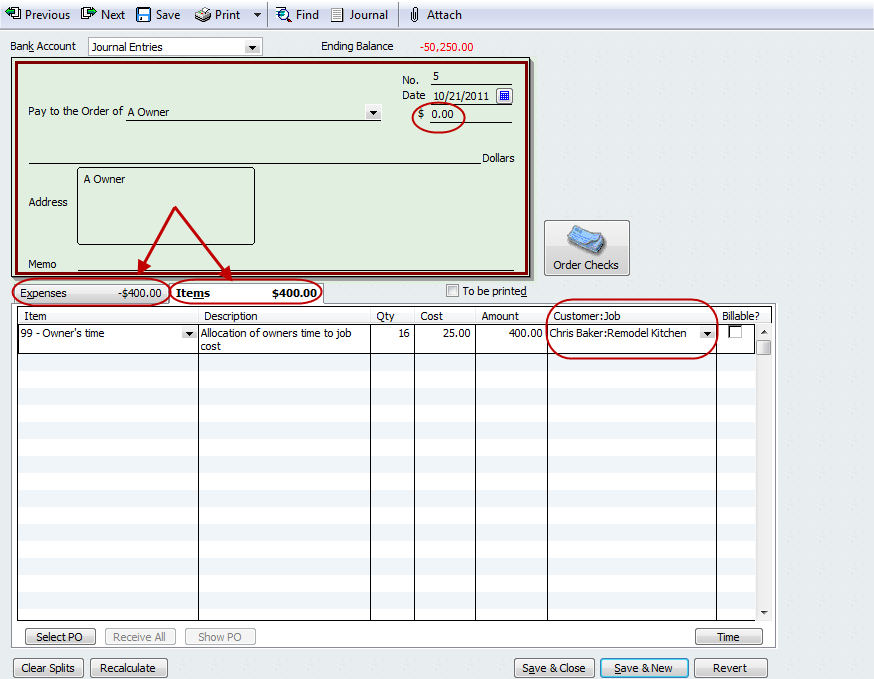

You can make business withdrawals through a cheque from your business bank account. To record a transaction between the business and owners account go into the banking menu in quickbooks and select the option titled write checks.

Owner S Draw Quickbooks Tutorial

If you are a sole proprietor who takes an owners draw you can still qualify for the Paycheck Protection Program.

. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck. Go to the Advanced tab and pick Categories. Select the Gear icon at the top and then select Chart of Accounts.

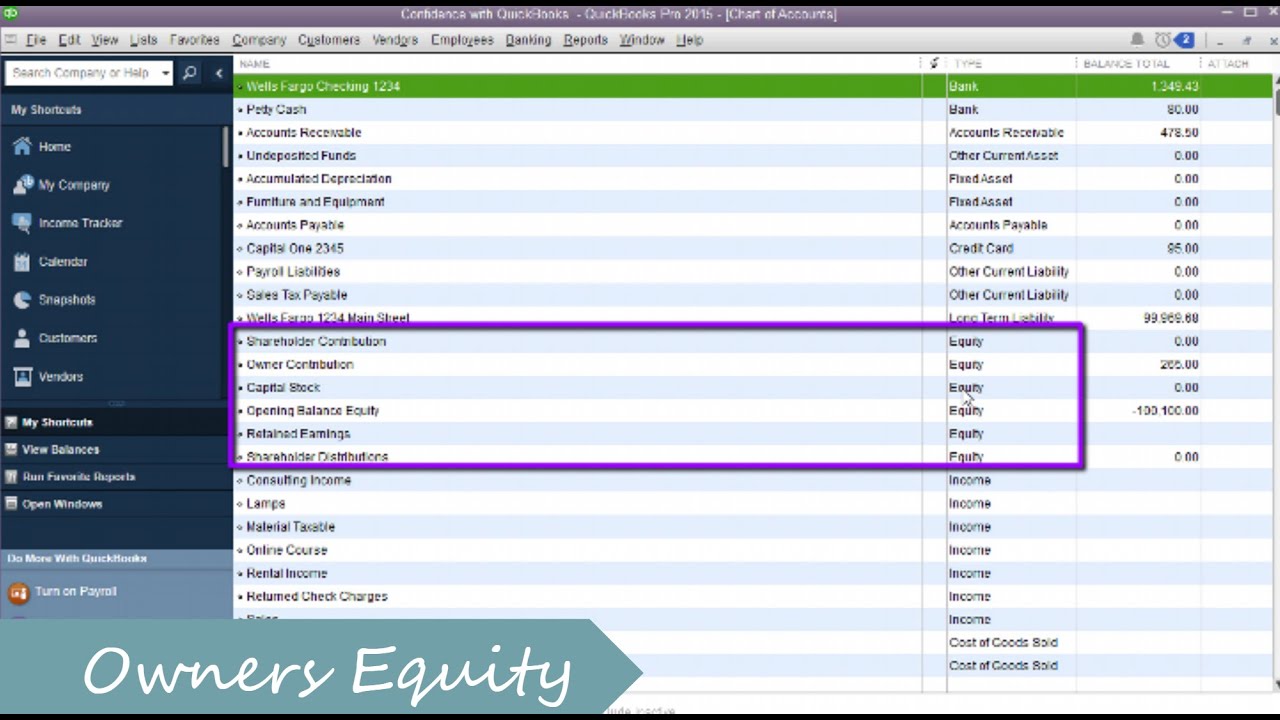

Enter Owner Draws as the account name and click OK. Perhaps If You Sell 10 Widgets You Get A Bonus Of 10 But If You Sell 20 Widgets You Get A Bonus Of 30. Owners equity owners investment or owners draw.

Thus you can pay for your expenses once the funds are deposited into your account. Click on that under the Detail Type drop-down menu. If you are using QuickBooks Online Accountant there is a tool for reconciliation.

Enter the contribution amount in the balance field. From the Detail Type drop-down choose Owners Equity. In the Chart of Accounts window select New.

How do you handle owner draws in QuickBooks. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period. You have an owner you want to pay in QuickBooks.

Set up and process an owners draw account Overview. Go to Banking Write Checks. S Corporations use Owners equity to show the.

How do I run an owners draw in QuickBooks. No tax is payable by the owners on drawings but instead they pay tax on their share of the net income generated by the business. You can also use the CTRL A keyboard shortcut to select Lists Chart of Accounts.

I have Quickbooks Simple Start online for my business and I. Under account type select equity. Select Save and then Done.

Type Equity in the drop-down menu next to Account Type. The owners reimbursement should now be recorded in your quickbooks account. Owners draws or withdrawals is never an expense.

How to Record Owner Draws Into QuickBooks Click the List option on the menu bar at the top of the window. How Does the Owners Draw Work. If you own a business you should pay yourself through the owners draw account.

An owners draw can also be a non-cash asset such as a. Choose Chart of Accounts from the Settings menu. Do drawings count as expenses.

An owners draw account is an equity account in which QuickBooks Desktop tracks withdrawals of the companys. Under category select the owners equity account then enter the. How Do You Handle Owner Draws In Quickbooks.

I would think 1099 would be incorrect given the Schedule C for the business would be as part of the married filing jointly 1040. An owners draw refers to an owner taking funds out of the business for personal use. If a client needs to undo a transaction then you can use Undo and Resume Solution.

Many small business owners compensate themselves using a draw rather than paying themselves a salary. How Do I Set Up A Partnership In Quickbooks. From the Account Type drop-down choose Equity.

The Defining the Owners Partners Equity section will determine what your situation is. Heres how to do it. Mark the Track classes to turn on class tracking.

To open an owners draw account follow these steps. Owner S Draw Quickbooks Tutorial How To Read Your Quickbooks Online Profit Loss Report Deximal How To Setup And Use Owners Equity In Quickbooks Pro Youtube How To Pay Invoices Using Owner S Draw Quickbooks Online Tutorial Part 18 Viewing And Creating Reports Youtube Owners Draw Balances. Drawings or loans taken by owners are not counted as taxable income in their hands instead profits distributed as how to pay yourself in quickbooks llc unit trust distributions or family trust distributions are taxed.

When income is earned by an s. How To Undo Reconciliation In QuickBooks Online. We managed three companies Ill focus on two of them since I dont think the third will be a big deal if I figure out the rest - lets call them MainC and AuxC -.

Draws can happen at regular intervals or when needed. Click the Expenses tab and then select the account category that best fits your needs. Draws can happen at regular intervals or when needed.

Click Save and Close. Select the Bank Account Cash Account or Credit Card you used to make the purchase. To create an Equity account.

From the PAY TO THE ORDER OF field select the vendors name. Youll need to use the information from your income tax Schedule C form from the previous year. For background our company used Quickbooks Enterprise for quite some time until 2017 last version we bought.

The most common way to take an owners draw is by writing a check that transfers cash from your business account to your personal account. Click Chart of Accounts and click Add Select the Equity account option. Quickbooks to TurboTax online.

Specifically you want to use the net profit from Line 31 and divide that 12 to get an average monthly net profit. Choose Lists Chart of Accounts or press CTRL A on your keyboard. Enter the Amount of the purchase.

Choose New from the list. You will pay the owner using an owners draw account. How do you record an owners draw in QuickBooks.

Enter the account name and description Owners Draw is recommended. Click Account New at the bottom left. This is unlike the case of an employee who is paid a salary via a payroll service that deducts employment taxes automatically.

Is owners draw an expense. If you want to know the following steps then visit our website to get proper information. At the end of the year or period subtract your owners draw account balance from your owners equity account total.

Continue By clicking Equity at the end of the page. Select an account by clicking on New under Account. Perhaps make a new account to separate out Owners Draw per owner.

Patty could withdraw profits generated by her business or take out funds that she previously contributed to her company. Does owner draw show up. Posted by 2 days ago.

Owners draw balances Tap the Gear icon and choose Account and Settings. The business owner takes funds out of the business for personal use. Youll need to enter an account name as well as a description Owners Draw is recommended.

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

How To Pay Invoices Using Owner S Draw

How To Record An Owner S Draw The Yarny Bookkeeper

How To Record An Owner S Draw The Yarny Bookkeeper

Quickbooks Owner Draws Contributions Youtube

Solved Separting Owner S Salary

Quickbooks Learn Support Online Qbo Support How To Set Up An Owner S Draw Account In The Chart Of Accounts

How To Set Up Owners Draw In Quickbooks Guide Smb Accountants

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

How To Record Owner S Equity Draws In Quickbooks Online Youtube

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

Setup And Pay Owner S Draw In Quickbooks Online Desktop

Quickbooks Learn Support Online Qbo Support Owner S Draw On Self Employed Qb

How To Record Owner Investment In Quickbooks Updated Steps

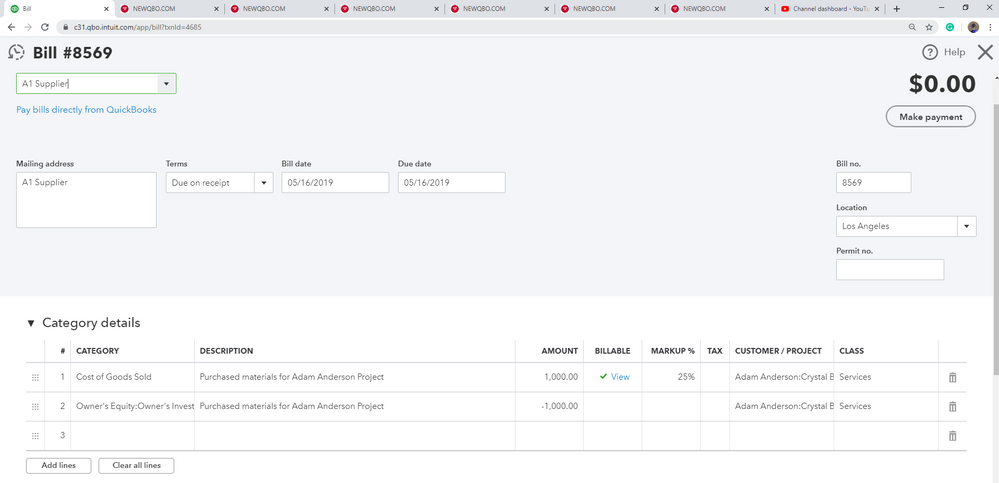

How Do I Make A J E With A Cr To Owner S Draw And Properly Record It In Cog Sold I Am Using Qbo Adv I Bought Items With My Personal Money That